Medical billing has never been more complex. As we move into 2026, evolving coding frameworks, shifting payer directives, and mounting compliance expectations mean that every claim must be right the first time. For healthcare practices, missteps in claim submission are no longer minor inconveniences—they’re revenue leaks.

At Konnext Solutions, we recommend adopting a structured “error-free claims checklist” to transform your billing department from reactive to resilient.

Why You Need a Checklist Now

- Denial rates are rising. Up to 10-15% of claims may be rejected on the first pass.

- Errors missing data, incorrect codes, incomplete documentation, drive the bulk of denials.

- Each denied claim means lost revenue, extra staffing time, and compliance risk.

- With a focused checklist, practices can improve clean claim submission and accelerate reimbursement.

Common Billing Mistakes That Cost You

- Incorrect Patient or Insurance Data

Demographic errors, outdated coverage info, or wrong insurance IDs can cause immediate rejections. Verification at intake is critical.

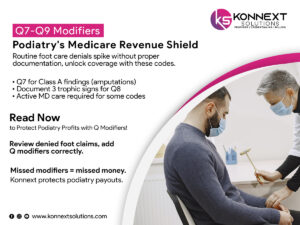

- Outdated or Inaccurate Procedure/Diagnosis Codes

Using codes that don’t match the service rendered or failing to apply the right modifiers, leads to denials. Ensure CPT and ICD-10 are current for 2026.

- Incomplete Documentation

Missing provider signatures, lack of justification for medical necessity, or insufficient progress notes trigger claim failures. Clear documentation must support each billed service.

- Wrong Billing Entity or Place-of-Service Information

Errors in NPI numbers, tax IDs, facility vs. office billing, or place-of-service codes are avoidable but costly when they occur.

Your 2026 Error-Free Claims Checklist

Pre-Submission Verification

- Confirm patient eligibility and benefits coverage active, copays/deductibles verified.

- Validate demographic and insurance fields: name, date of birth, policy number, provider details.

Coding and Linking Accuracy

- Apply the most recent CPT/ICD‐10 codes.

- Match procedure codes to documented services accurate modifiers for bilateral/multiple services.

- Ensure diagnosis supports the service and meets payer requirement for medical necessity.

Documentation Review

- All notes signed and dated; electronic signatures compliant.

- Encounter documentation supports billed level of service.

- Surgical, consult, and progress notes complete and attached when required.

Payer-Specific Rules Check

- Review payer rules: prior authorizations, timely filing deadlines, required formats.

- Maintain a list of top payers and their specific guidelines for quick reference.

Final Quality Assurance

- Double-check claim fields, attachments, provider information.

- Use claim scrubbing tools where available.

- Confirm all items on the checklist are marked “verified” before submission.

Leveraging Technology to Support the Process

While human checks are essential, technology significantly strengthens your process:

- Real-time eligibility verification tools catch coverage issues early.

- Automated claim scrubbing flags coding mismatches and missing data.

- Analytics dashboards help you track denial trends, clean-claim rates, and AR aging.

The Financial Impact of Clean Claims

When you reduce errors and improve first-pass acceptance:

- Clean claim rates can shift from ~75% to 90%+ with disciplined processes.

- AR days shrink, leading to faster cash flow and less working capital tied up.

- Denials reduce, which means fewer appeals, less staff time, and fewer write-offs.

Training Your Team for Consistency

Your checklist only works if your team uses it consistently. To ensure success:

- Conduct regular training on coding updates, payer rules, and documentation standards.

- Assign ownership: each billing staff member knows which checklist items they are responsible for.

- Conduct monthly audits to identify common errors and refine protocols accordingly.

Partnering with Konnext Solutions for Claim Accuracy

At Konnext Solutions, we provide:

- A tailored claims-accuracy framework built around your specialty and payer mix.

- Advanced scrubbing, denial-prevention analytics, and expert coding oversight.

- Seamless integration with your existing EMR/practice-management system, no need to rip and replace your tools.

- Ongoing consulting to refine billing workflows, reduce denials, and protect your revenue stream.